What looked too good to be true ended up being just that, as Bitconnect has all but closed its doors. Long accused of being a Ponzi-scheme, Bitconnect shut down its cryptocurrency exchange and lending service this week. As stated on their website, Bitconnect had received cease and desist letters from two American securities regulators – leading to the closure of their lending and exchange platforms. Still, Bitconnect will continue to run its website and wallet service.

Sketchy ‘Ponzi’ offerings

Since its inception in January 2017, many were skeptical about Bitconnect services. In essence, one needed to send Bitconnect Bitcoin in exchange for Bitconnect Coin (BCC) on their exchange. Once you had BCC, you were guaranteed “up to 120 percent return per year.” Users were told they were earning interest by holding their coin “for helping maintain the security of the network.”

Lending platform

Bitconnect’s lending platform is what really led to accusations of a Ponzi scheme, as well as cease and desist orders from regulators.

Source: Bitconnect.co

As the above illustration explains, users bought BCC with Bitcoin and then lent out their BCC on the Bitconnect lending software.

Users would receive varying percentages of interest depending on the amount of BCC they had lent.

Source: Bitconnect.co

Add in the referral system seen in many other Ponzi schemes and the fact that the operation was run anonymously; it’s hardly surprising that this whole endeavor has ended in tears.

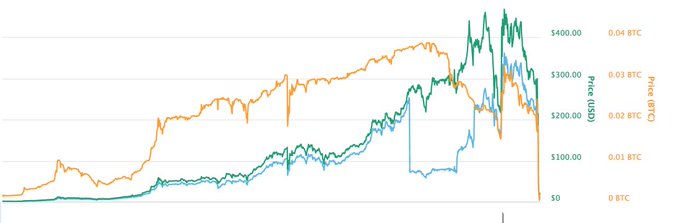

The lending scheme was the main draw card of Bitconnect because of its huge promise of returns. In order to participate in the scheme, you had to buy BCC – which saw the token hit an all-time high of $437.31 per BCC before it plummeted in value following the closure this week.

That being said, the cryptocurrency is still alive and trading at around $35 at the time of writing.

Social media burns Bitconnect

Following Bitconnect’s closure, social media was abuzz with sentiments of ‘I told you so.’

TenX co-founder Julian Hosp highlighted the fact that BCC was still trading as a real head-scratcher.

Francis Pouliot shared a hilarious video of a Bitconnect meet which had been slightly dubbed over.

American cartoonist Spike Trotman shared one of the most entertaining and eerily accurate predictions back in September 2017, postulating that Bitconnect was indeed a Ponzi scheme.

Her latest tweet is a screenshot of the Bitconnect Reddit page, with subreddits for a suicide hotline as well as a massive legal action megathread. Do yourself a favor and take a look at Iron Spike’s full threat on Bitconnect – it’s brilliant.

Rodolfo Novak shared a photo of the monumental collapse in price of Bitconnect from Coinmarketcap, highlight the moment the Ponzi scheme hits ‘exit time.’

Buy and Sell Cryptocurrencies – Start Trading

>> Open Account on Recommended Website <<

All trademarks, logos, and images displayed on this site belong to their respective owners and have been utilized under the Fair Use Act. The materials on this site should not be interpreted as financial advice. When we incorporate content from other sites, we ensure each author receives proper attribution by providing a link to the original content. This site might maintain financial affiliations with a selection of the brands and firms mentioned herein. As a result, we may receive compensation if our readers opt to click on these links within our content and subsequently register for the products or services on offer. However, we neither represent nor endorse these services, brands, or companies. Therefore, any disputes that may arise with the mentioned brands or companies need to be directly addressed with the respective parties involved. We urge our readers to exercise their own judgement when clicking on links within our content and ultimately signing up for any products or services. The responsibility lies solely with them. Please read our full disclaimer and terms of use policy here.